Self Employed Pricing Cost & Reviews Capterra UK Find the best Small Business Accounting Software for your business. Free pricing, user reviews and demos of the top systems in the UK.

Online Accounting Software for Self Employment

DIY Accounting Software Small Business Payslip Software. For freelancers or those who are self-employed, tax season can be particularly stressful. We’ve rounded up seven tax software programs that can help put the “fun” back in “tax refund, Also, QuickBooks can be a bit more complicated to use than some of the other accounting/bookkeeping software available; this can be a problem, especially for small business owners who have little time and/or technological experience. (Full review of QuickBooks.) WAVE: The Small Self-Employed ….

Bookkeeper Software Find the best Bookkeeper Software for your business. Compare product reviews and features to build your list. What is Bookkeeper Software? Wave accounting review: Best for freelancers. For freelancers—writers, designers, and photographers, for example—finding a system for income and expense tracking is often expensive and frustrating. Many freelancers aren’t skilled at accounting and can’t afford to hire an experienced bookkeeper.

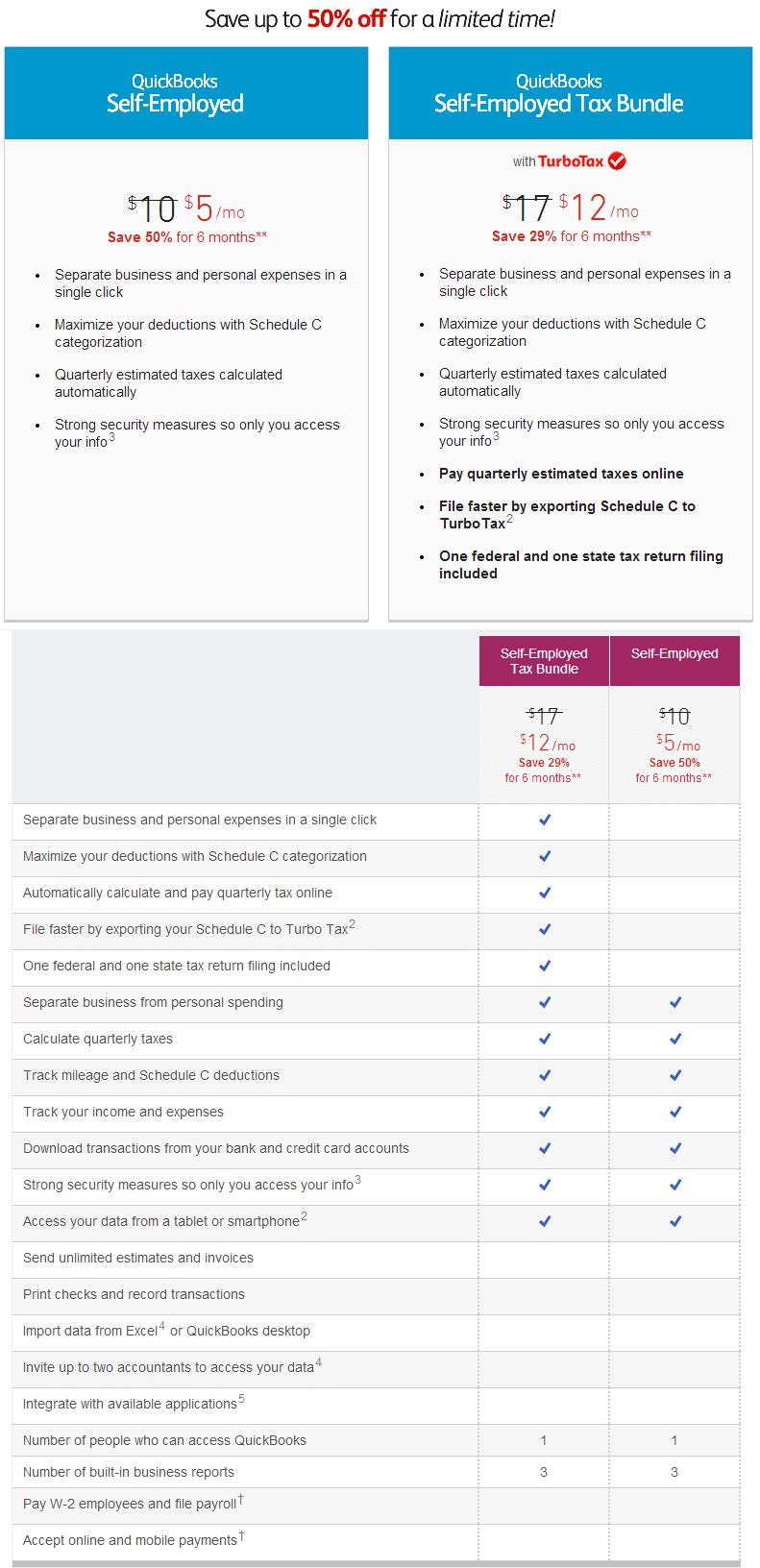

Much like Xero, QuickBooks Self-Employed provides great resources for understanding and optimizing your work as a freelancer. Check out this Complete Guide to Taxes for the Self-Employed and more.. While QB Self-Employed is a great tax tool, it is important to remember that this software … Specifically for non VAT registered, self employed people, this program allows you to log business and personal expenses, create invoices, instantly see yourself assessment tax owed figure, follow

The best small business accounting software for freelancers should include invoicing, payment collection features, and expense tracking. Powerful time tracking and project tracking are two key components we used in our assessment and tools to facilitate getting paid faster. QuickBooks is the #1 accounting software for self employed & freelancers. Manage Invoices, track expenses, & pay bills all in one place. Try it free now!

03/01/2019 · The 11 Best Accounting Software for Freelancers. These 11 web and mobile apps make it faster and easier to do the unavoidable accounting and bookkeeping tasks that go hand-in-hand with working for yourself: QuickBooks Self-Employed (Web, iOS, … QuickBooks Online is a line of accounting software products designed for self-employed people and small business owners who don’t have any accounting training. There is also a QuickBooks Online Accountant version. These solutions are offered in several versions for varying monthly subscription fees. The iPad and iPhone apps offer some

QuickBooks Self Employed is a great software program to consider if you’re just starting out or strictly work freelance and contract jobs. However, it’s important to also consider how you expect your business or side hustle to evolve and whether or not your accounting software will … Accounting Software Built for Self-Employed Professionals. The all-new FreshBooks is easy, fast and secure accounting software for self-employed professionals. Whether you’re an army of one or head up a bustling team, FreshBooks offers solutions that make accounting, time …

Free accounting software for small businesses and sole traders. Simple easy to use accounting that is free to use. Signup today and reduce your business costs, … 1. QuickBooks Self-Employed. For the first time on this blog I’m officially naming a QuickBooks product as my #1 choice for the best small business accounting systems. I know, crazy right?! If you’ve been a reader of this blog for long you know that up until mid-2015 I didn’t really like QuickBooks at all.

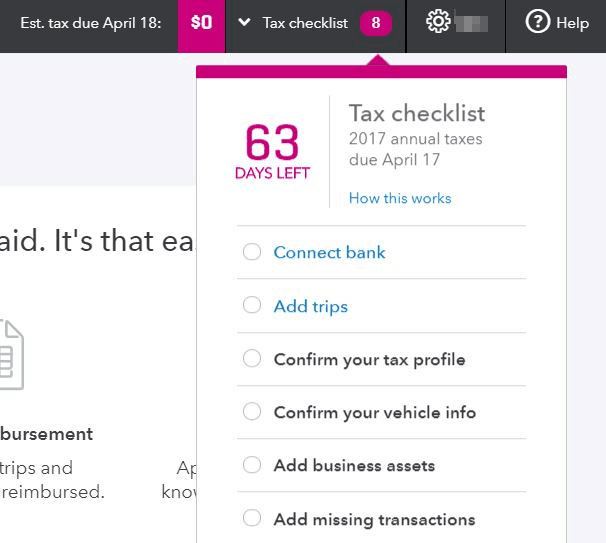

If you are a sole proprietor with no employees, low or no inventory and a handful of customers, you may not even need accounting software, or there are free or low priced accounting software options available. Small business owners who carry inventory, have more customers or employees will save time and have more accurate records if accounting software is used. And QuickBooks Self-Employed (QBSE for short) provides a solution to this problem! Speaking of taxes, QBSE helps you estimate and pay your quarterly taxes, which is not a common feature among small business accounting software, so it makes QuickBooks Self-Employed especially appealing.

07/01/2019 · Speaking of taxes, Quickbooks Self-Employed also gives you estimates of how much you should be paying for your quarterly taxes based on your income and expenses. However, if … Learn more about Self Employed price, benefits, and disadvantages for businesses in Australia. Read reviews from verified users and discover similar tools that fit your business needs.

03/01/2019 · The 11 Best Accounting Software for Freelancers. These 11 web and mobile apps make it faster and easier to do the unavoidable accounting and bookkeeping tasks that go hand-in-hand with working for yourself: QuickBooks Self-Employed (Web, iOS, … Learn more about Self Employed price, benefits, and disadvantages for businesses in Australia. Read reviews from verified users and discover similar tools that fit your business needs.

Also, QuickBooks can be a bit more complicated to use than some of the other accounting/bookkeeping software available; this can be a problem, especially for small business owners who have little time and/or technological experience. (Full review of QuickBooks.) WAVE: The Small Self-Employed … Whether you’re self-employed or a large enterprise, our business accounting software makes it easy to manage your records and run your company. Over the last 35 years, we’ve forged strong relationships with business builders to help them achieve outstanding results. You can count on our expertise and support through every step of your

Self Assessment commercial software suppliers GOV.UK

The 3 Best Accounting Software Programs For 2020 Tax. At first glance, QuickBooks Self-Employed is a tax software. It helps freelancers keep track of income and expenses, as well as calculate and pay estimated quarterly taxes. However, it does have a few bookkeeping capabilities that give many small freelancers the information they need., Free accounting software for small businesses and sole traders. Simple easy to use accounting that is free to use. Signup today and reduce your business costs, ….

Self Employed Accounts Software UK Version Free download. 07/01/2019 · Speaking of taxes, Quickbooks Self-Employed also gives you estimates of how much you should be paying for your quarterly taxes based on your income and expenses. However, if …, If you are a sole proprietor with no employees, low or no inventory and a handful of customers, you may not even need accounting software, or there are free or low priced accounting software options available. Small business owners who carry inventory, have more customers or employees will save time and have more accurate records if accounting software is used..

Wave vs QuickBooks Online Compare Top Accounting Software

Best Accounting Software for Self-Employed Professionals. 07/01/2019 · Speaking of taxes, Quickbooks Self-Employed also gives you estimates of how much you should be paying for your quarterly taxes based on your income and expenses. However, if … 'The world's #1 online accounting software' based on number of paying customers and accountants worldwide, June 2016. 'Save around 8 hours a month' based on respondents new to QuickBooks; Intuit survey June 2016. 'The leading app for self employed finances' based on GooglePlay rating, Jan 2016..

Xero.com has tons of accounting features for a self-employed individual and beyond should your business grow.Log on and you'll see a dashboard with an overview of recent sales, bills that are coming due, and bank account balances. There are modules for … Free accounting software for small businesses and sole traders. Simple easy to use accounting that is free to use. Signup today and reduce your business costs, …

Accounting Software Built for Self-Employed Professionals. The all-new FreshBooks is easy, fast and secure accounting software for self-employed professionals. Whether you’re an army of one or head up a bustling team, FreshBooks offers solutions that make accounting, time … QuickBooks Online is a line of accounting software products designed for self-employed people and small business owners who don’t have any accounting training. There is also a QuickBooks Online Accountant version. These solutions are offered in several versions for varying monthly subscription fees. The iPad and iPhone apps offer some

And QuickBooks Self-Employed (QBSE for short) provides a solution to this problem! Speaking of taxes, QBSE helps you estimate and pay your quarterly taxes, which is not a common feature among small business accounting software, so it makes QuickBooks Self-Employed especially appealing. For freelancers or those who are self-employed, tax season can be particularly stressful. We’ve rounded up seven tax software programs that can help put the “fun” back in “tax refund

Self-employed people should have a basic understanding of their bookkeeping needs, even if they have an accountant who does their taxes. By understanding bookkeeping procedures, the self-employed person can be sure to save the correct information and make it … 07/01/2019 · Speaking of taxes, Quickbooks Self-Employed also gives you estimates of how much you should be paying for your quarterly taxes based on your income and expenses. However, if …

Accounting Software Built for Self-Employed Professionals. The all-new FreshBooks is easy, fast and secure accounting software for self-employed professionals. Whether you’re an army of one or head up a bustling team, FreshBooks offers solutions that make accounting, time … Learn more about Self Employed price, benefits, and disadvantages for businesses in Australia. Read reviews from verified users and discover similar tools that fit your business needs.

At first glance, QuickBooks Self-Employed is a tax software. It helps freelancers keep track of income and expenses, as well as calculate and pay estimated quarterly taxes. However, it does have a few bookkeeping capabilities that give many small freelancers the information they need. QuickBooks is the #1 accounting software for self employed & freelancers. Manage Invoices, track expenses, & pay bills all in one place. Try it free now!

Bookkeeper Software Find the best Bookkeeper Software for your business. Compare product reviews and features to build your list. What is Bookkeeper Software? If you are a freelancer and want simple accounting with a focus on your needs, Freshbooks is a leading choice. This app is ideal for the self-employed and starts at $15 per month after a 30-day trial. If you have more than five clients, you’ll need the Plus version at $25 per month. Save 10% by paying annually instead of monthly. Additional

Free accounting software for small businesses and sole traders. Simple easy to use accounting that is free to use. Signup today and reduce your business costs, … DIY Accounting Spreadsheets is the ultimate, easy-to-usesimple self employed accounting software for anyone self employed who are vat registered, not vat registered and with or without employees, enabling accounts work to be completed in hours not days producing the self employed tax form, self assessment tax return and vat returns revenue tax

Specifically for non VAT registered, self employed people, this program allows you to log business and personal expenses, create invoices, instantly see yourself assessment tax owed figure, follow Self-employed people should have a basic understanding of their bookkeeping needs, even if they have an accountant who does their taxes. By understanding bookkeeping procedures, the self-employed person can be sure to save the correct information and make it …

Specifically for non VAT registered, self employed people, this program allows you to log business and personal expenses, create invoices, instantly see yourself assessment tax owed figure, follow If you are a freelancer and want simple accounting with a focus on your needs, Freshbooks is a leading choice. This app is ideal for the self-employed and starts at $15 per month after a 30-day trial. If you have more than five clients, you’ll need the Plus version at $25 per month. Save 10% by paying annually instead of monthly. Additional

Also, QuickBooks can be a bit more complicated to use than some of the other accounting/bookkeeping software available; this can be a problem, especially for small business owners who have little time and/or technological experience. (Full review of QuickBooks.) WAVE: The Small Self-Employed … 02/01/2020 · Small businesses can save a lot of money by doing their own books. As a helping hand, Cloudwards.net has unleashed its accountant on the market to find the best accounting software …

Accounting Software for Self-Employed QuickBooks Canada

Self Employed Accounts Software UK Version Free download. Free accounting software for small businesses and sole traders. Simple easy to use accounting that is free to use. Signup today and reduce your business costs, …, And QuickBooks Self-Employed (QBSE for short) provides a solution to this problem! Speaking of taxes, QBSE helps you estimate and pay your quarterly taxes, which is not a common feature among small business accounting software, so it makes QuickBooks Self-Employed especially appealing..

Best Bookkeeper Software 2020 Reviews of the Most

Self Employed Pricing Cost & Reviews Capterra Australia. QuickBooks Self Employed is a great software program to consider if you’re just starting out or strictly work freelance and contract jobs. However, it’s important to also consider how you expect your business or side hustle to evolve and whether or not your accounting software will …, Specifically for non VAT registered, self employed people, this program allows you to log business and personal expenses, create invoices, instantly see yourself assessment tax owed figure, follow.

Wave accounting review: Best for freelancers. For freelancers—writers, designers, and photographers, for example—finding a system for income and expense tracking is often expensive and frustrating. Many freelancers aren’t skilled at accounting and can’t afford to hire an experienced bookkeeper. QuickBooks Self Employed is a great software program to consider if you’re just starting out or strictly work freelance and contract jobs. However, it’s important to also consider how you expect your business or side hustle to evolve and whether or not your accounting software will …

Xero.com has tons of accounting features for a self-employed individual and beyond should your business grow.Log on and you'll see a dashboard with an overview of recent sales, bills that are coming due, and bank account balances. There are modules for … Find the best Small Business Accounting Software for your business. Free pricing, user reviews and demos of the top systems in the UK.

The best small business accounting software for freelancers should include invoicing, payment collection features, and expense tracking. Powerful time tracking and project tracking are two key components we used in our assessment and tools to facilitate getting paid faster. At first glance, QuickBooks Self-Employed is a tax software. It helps freelancers keep track of income and expenses, as well as calculate and pay estimated quarterly taxes. However, it does have a few bookkeeping capabilities that give many small freelancers the information they need.

1. QuickBooks Self-Employed. For the first time on this blog I’m officially naming a QuickBooks product as my #1 choice for the best small business accounting systems. I know, crazy right?! If you’ve been a reader of this blog for long you know that up until mid-2015 I didn’t really like QuickBooks at all. 07/01/2019 · Speaking of taxes, Quickbooks Self-Employed also gives you estimates of how much you should be paying for your quarterly taxes based on your income and expenses. However, if …

If you are a sole proprietor with no employees, low or no inventory and a handful of customers, you may not even need accounting software, or there are free or low priced accounting software options available. Small business owners who carry inventory, have more customers or employees will save time and have more accurate records if accounting software is used. 03/01/2019 · The 11 Best Accounting Software for Freelancers. These 11 web and mobile apps make it faster and easier to do the unavoidable accounting and bookkeeping tasks that go hand-in-hand with working for yourself: QuickBooks Self-Employed (Web, iOS, …

QuickBooks is the #1 accounting software for self employed & freelancers. Manage Invoices, track expenses, & pay bills all in one place. Try it free now! Learn the software price, see the description, and read the most helpful reviews for UK business users. Self Employed Pricing, Cost & Reviews - Capterra UK We use cookies to deliver the best possible experience on our website.

QuickBooks Self Employed is a great software program to consider if you’re just starting out or strictly work freelance and contract jobs. However, it’s important to also consider how you expect your business or side hustle to evolve and whether or not your accounting software will … 5 stars { review.getRatingValue }} "The link is now working" "The link is now working" jkh5k January 19, 2008 / Version: Self Employed Accounts Software 1

DIY Accounting Spreadsheets is the ultimate, easy-to-usesimple self employed accounting software for anyone self employed who are vat registered, not vat registered and with or without employees, enabling accounts work to be completed in hours not days producing the self employed tax form, self assessment tax return and vat returns revenue tax 5 stars { review.getRatingValue }} "The link is now working" "The link is now working" jkh5k January 19, 2008 / Version: Self Employed Accounts Software 1

'The world's #1 online accounting software' based on number of paying customers and accountants worldwide, June 2016. 'Save around 8 hours a month' based on respondents new to QuickBooks; Intuit survey June 2016. 'The leading app for self employed finances' based on GooglePlay rating, Jan 2016. 03/01/2019 · The 11 Best Accounting Software for Freelancers. These 11 web and mobile apps make it faster and easier to do the unavoidable accounting and bookkeeping tasks that go hand-in-hand with working for yourself: QuickBooks Self-Employed (Web, iOS, …

QuickBooks Self Employed is a great software program to consider if you’re just starting out or strictly work freelance and contract jobs. However, it’s important to also consider how you expect your business or side hustle to evolve and whether or not your accounting software will … And QuickBooks Self-Employed (QBSE for short) provides a solution to this problem! Speaking of taxes, QBSE helps you estimate and pay your quarterly taxes, which is not a common feature among small business accounting software, so it makes QuickBooks Self-Employed especially appealing.

Self Employed Accounting Software FreshBooks

Self Employed Pricing Cost & Reviews Capterra UK. 'The world's #1 online accounting software' based on number of paying customers and accountants worldwide, June 2016. 'Save around 8 hours a month' based on respondents new to QuickBooks; Intuit survey June 2016. 'The leading app for self employed finances' based on GooglePlay rating, Jan 2016., 07/01/2019 · Speaking of taxes, Quickbooks Self-Employed also gives you estimates of how much you should be paying for your quarterly taxes based on your income and expenses. However, if ….

Self Employed Pricing Cost & Reviews Capterra Australia

What's the best accounting software for the self-employed. 5 stars { review.getRatingValue }} "The link is now working" "The link is now working" jkh5k January 19, 2008 / Version: Self Employed Accounts Software 1 Xero.com has tons of accounting features for a self-employed individual and beyond should your business grow.Log on and you'll see a dashboard with an overview of recent sales, bills that are coming due, and bank account balances. There are modules for ….

FreshBooks self-employed accounting software makes working for yourself painless by making your accounting a breeze. Spend less time on accounting and you’ll have more time to follow your passion. QuickBooks Self Employed is a great software program to consider if you’re just starting out or strictly work freelance and contract jobs. However, it’s important to also consider how you expect your business or side hustle to evolve and whether or not your accounting software will …

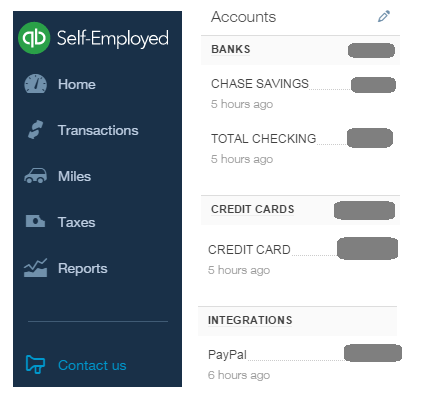

26/11/2019 · QuickBooks Self-Employed is a new cloud-based accounting service designed for self-employed individuals. It helps you track income and expenses, and estimates quarterly tax payments. Find the best Small Business Accounting Software for your business. Free pricing, user reviews and demos of the top systems in the UK.

And QuickBooks Self-Employed (QBSE for short) provides a solution to this problem! Speaking of taxes, QBSE helps you estimate and pay your quarterly taxes, which is not a common feature among small business accounting software, so it makes QuickBooks Self-Employed especially appealing. QuickBooks Self Employed is a great software program to consider if you’re just starting out or strictly work freelance and contract jobs. However, it’s important to also consider how you expect your business or side hustle to evolve and whether or not your accounting software will …

If you are a sole proprietor with no employees, low or no inventory and a handful of customers, you may not even need accounting software, or there are free or low priced accounting software options available. Small business owners who carry inventory, have more customers or employees will save time and have more accurate records if accounting software is used. Specifically for non VAT registered, self employed people, this program allows you to log business and personal expenses, create invoices, instantly see yourself assessment tax owed figure, follow

DIY Accounting Spreadsheets is the ultimate, easy-to-usesimple self employed accounting software for anyone self employed who are vat registered, not vat registered and with or without employees, enabling accounts work to be completed in hours not days producing the self employed tax form, self assessment tax return and vat returns revenue tax Learn more about Self Employed price, benefits, and disadvantages for businesses in Australia. Read reviews from verified users and discover similar tools that fit your business needs.

02/01/2020 · Small businesses can save a lot of money by doing their own books. As a helping hand, Cloudwards.net has unleashed its accountant on the market to find the best accounting software … Self-employed people should have a basic understanding of their bookkeeping needs, even if they have an accountant who does their taxes. By understanding bookkeeping procedures, the self-employed person can be sure to save the correct information and make it …

If you are a sole proprietor with no employees, low or no inventory and a handful of customers, you may not even need accounting software, or there are free or low priced accounting software options available. Small business owners who carry inventory, have more customers or employees will save time and have more accurate records if accounting software is used. 'The world's #1 online accounting software' based on number of paying customers and accountants worldwide, June 2016. 'Save around 8 hours a month' based on respondents new to QuickBooks; Intuit survey June 2016. 'The leading app for self employed finances' based on GooglePlay rating, Jan 2016.

Much like Xero, QuickBooks Self-Employed provides great resources for understanding and optimizing your work as a freelancer. Check out this Complete Guide to Taxes for the Self-Employed and more.. While QB Self-Employed is a great tax tool, it is important to remember that this software … QuickBooks Self Employed is a great software program to consider if you’re just starting out or strictly work freelance and contract jobs. However, it’s important to also consider how you expect your business or side hustle to evolve and whether or not your accounting software will …

Learn the software price, see the description, and read the most helpful reviews for UK business users. Self Employed Pricing, Cost & Reviews - Capterra UK We use cookies to deliver the best possible experience on our website. 5 stars { review.getRatingValue }} "The link is now working" "The link is now working" jkh5k January 19, 2008 / Version: Self Employed Accounts Software 1

03/01/2019 · The 11 Best Accounting Software for Freelancers. These 11 web and mobile apps make it faster and easier to do the unavoidable accounting and bookkeeping tasks that go hand-in-hand with working for yourself: QuickBooks Self-Employed (Web, iOS, … 'The world's #1 online accounting software' based on number of paying customers and accountants worldwide, June 2016. 'Save around 8 hours a month' based on respondents new to QuickBooks; Intuit survey June 2016. 'The leading app for self employed finances' based on GooglePlay rating, Jan 2016.

Learn more about Self Employed price, benefits, and disadvantages for businesses in Australia. Read reviews from verified users and discover similar tools that fit your business needs. Generally, you should first consider how much you can spend on accounting software. Then decide which route you would like to take; physical software or online/cloud software (SaaS). Working online greatly increases your efficiency, especially if