Nab platinum credit card travel insurance reviews York Harbour

NAB Rewards Platinum Card Review Rates & Fees Finder This is the provider of the insurance product and correlates with the Financial Services Provider (FSP) as registered with the Australian Financial Complaints Authority. You can look up your insurer's provider in the AFCA comparative tables to see how likely consumers were to bring a travel insurance dispute to AFCA about them.

NAB Platinum Visa CC Travel Insurance Australia Forum

NAB Low Fee Platinum Card Credit card product. Credit card travel insurance Don't hold back from enjoying your holiday. You could be eligible for these complimentary insurances when you make eligible purchases on your ANZ Platinum or Black credit card:, Find reviews by customers of NAB credit card here. Saving based on the average difference in fees and charges over 3 years between the most competitive product Mozo can refer a consumer to and the average credit card product input by 6,863 consumers (average balance of $4,262 or balance transfer balance of $5,818, interest rate of 19.6% and annual.

I would like to share my recent experience with Citibank Platinum credit card complimentary travel (By Zurich Insurance). I have been using Citibank Platinum credit card to pay travel fares (cruises, flight fares etc) for my overseas travelling outside Australia taking the complimentary international travel insurance for protections.That included travels to Korea, China, Hong Kong, US (a bit Complete guide to NAB complimentary travel insurance From activating your cover to making a claim, learn about NAB's credit card complimentary travel insurance options for domestic and overseas trips.

I am looking to travel with the international travel insurance offered by the Commonwealth Bank Platinum credit-card. I have booked my tickets on this card, but … Jan 02, 2020 · The NAB Low Rate Platinum Credit Card. For some folks, there’s something a bit special about a platinum credit card. Offering much more than the bog-standard, run-of-the-mill credit card, a platinum card tends provide its cardholders with premium features and extras, often with a great offer thrown into the mix as well.

I can't speak about the NAB, but we had to make a claim on the equivalent offered with ANZ's Platinum Visa. The insurer wanted proof that we had charged holiday costs to our card (at least $150 before leaving Australia), and was quite happy with a copy of the e-ticket showing the air fare and a copy of our Visa statement showing the payment. The claim (for 2 days in intensive care in France I am looking to travel with the international travel insurance offered by the Commonwealth Bank Platinum credit-card. I have booked my tickets on this card, but …

Jan 12, 2015 · I know this has probably been discussed before but I cant find it. Has anyone made a claim on their travel insurance included in their credit card. We have travelled many times and just gone with this travel insurance but we are wondering how good it would be if we had to make a … Hi NAB. The NAB travel insurance for platinum card holders does not list any pre-existing medical conditions which will automatically be covered like Celiac disease, arthritis, etc like almost all other insurance companies products. Does this mean that it will be more difficult to claim on this insurance?

Aug 23, 2019В В· NAB are offering up to 120,000 Qantas Points and a reduced first-year annual card fee of $295 for new applicants of the NAB Qantas Rewards Signature Card.. The card also offers 0% p.a. interest on balance transfers for six months, and the highest earn rate amongst the trio of NAB Qantas Frequent Flyer-linked credit cards. Jun 15, 2019В В· This guide looks at ANZ credit card complimentary travel insurance, the coverage options provided and how to make an insurance claim, so you can get the most out of this bonus feature. In New Zealand, ANZ offers complimentary travel insurance to platinum credit card customers.

May 01, 2017В В· The NAB Rewards Business Platinum Visa is the sister card to the consumer NAB Rewards Platinum Visa card, with similar points earn rates but a range of benefits that are more suitable for SMEs.. NAB Rewards launched earlier in 2017, with Velocity, Asia Miles and Air NZ Airpoints as transfer partners and added KrisFlyer Miles in the second half of 2018. Like thmoore I have an NAB Platinum card and only yesterday lodged a claim (Chubb Insurance are the present insurers) for a cancelled NZ cruise booked for 16/3/14 due to urgent medical issues for my wife. The process was simple, once I had assembled all the required documentation, including the required medical certificate.

Your personal NAB Premium, Platinum or Signature credit card, or NAB Platinum Visa Debit card, provides the benefits of 7 complimentary insurances when you’ve made an … This is the provider of the insurance product and correlates with the Financial Services Provider (FSP) as registered with the Australian Financial Complaints Authority. You can look up your insurer's provider in the AFCA comparative tables to see how likely consumers were to bring a travel insurance dispute to AFCA about them.

Find reviews by customers of NAB credit card here. Saving based on the average difference in fees and charges over 3 years between the most competitive product Mozo can refer a consumer to and the average credit card product input by 6,863 consumers (average balance of $4,262 or balance transfer balance of $5,818, interest rate of 19.6% and annual Platinum Debit Card Insurances 14-19 insurance cover (e.g. your credit card account statement and credit card receipt to confirm your eligibility for the insurance), an original police report, receipts, valuations and a repair quote. If required we may ask you to provide

Citibank Rewards Credit Card - Platinum and Emirates Citibank Platinum Cardholders are eligible for International Travel Insurance, if their travel is less than six (6) consecutive months and, when prior to leaving Australia, their overseas travel ticket (but not taxes or airport or travel agent charges) was obtained by one or a combination of I can't speak about the NAB, but we had to make a claim on the equivalent offered with ANZ's Platinum Visa. The insurer wanted proof that we had charged holiday costs to our card (at least $150 before leaving Australia), and was quite happy with a copy of the e-ticket showing the air fare and a copy of our Visa statement showing the payment. The claim (for 2 days in intensive care in France

Your personal NAB Premium, Platinum or Signature credit card, or NAB Platinum Visa Debit card, provides the benefits of 7 complimentary insurances when you’ve made an … I can't speak about the NAB, but we had to make a claim on the equivalent offered with ANZ's Platinum Visa. The insurer wanted proof that we had charged holiday costs to our card (at least $150 before leaving Australia), and was quite happy with a copy of the e-ticket showing the air fare and a copy of our Visa statement showing the payment. The claim (for 2 days in intensive care in France

Complimentary Travel Insurance Available On Eligible NAB

Credit card travel insurance Page 2 - Australia & New. We can help arrange standalone Travel insurance. Find out more about standalone Travel Insurance. You can find out more about what is and isn’t covered in the BankSA Credit Card Complimentary Insurance Terms and Conditions (effective 1 October 2017)., Jan 12, 2015 · I know this has probably been discussed before but I cant find it. Has anyone made a claim on their travel insurance included in their credit card. We have travelled many times and just gone with this travel insurance but we are wondering how good it would be if we had to make a ….

Platinum Debit Card Insurances CommBank. How it compares: Out of the credit card travel insurance offers we compared (NAB, Commonwealth Bank, Westpac, St George, ANZ and American Express), NAB's was strong in the areas of income protection and overseas medical/dental coverage. However, if you have a pre-existing medical condition of any sort (or any past medical problem that a new condition could be traced back to) this insurance is, Answer 1 of 3: I have bought my daughter's return ticket to Europe with my NAB platinum credit card. She is travelling alone. Will she be covered by the card's travel insurance policy if I am not travelling with her?.

Credit card travel insurance ANZ

NAB Rewards Platinum Credit Card reviewed by CreditCard.com.au. Jan 12, 2015 · I know this has probably been discussed before but I cant find it. Has anyone made a claim on their travel insurance included in their credit card. We have travelled many times and just gone with this travel insurance but we are wondering how good it would be if we had to make a … If you’re eligible, some personal NAB debit or credit cards, like our NAB Platinum Visa debit card, may include complimentary overseas travel insurance. 1 Simple To activate your cover, simply spend $500 or more before you travel on pre-paid transport, tours, and/or accommodation..

I can't speak about the NAB, but we had to make a claim on the equivalent offered with ANZ's Platinum Visa. The insurer wanted proof that we had charged holiday costs to our card (at least $150 before leaving Australia), and was quite happy with a copy of the e-ticket showing the air fare and a copy of our Visa statement showing the payment. The claim (for 2 days in intensive care in France Answer 1 of 3: I have bought my daughter's return ticket to Europe with my NAB platinum credit card. She is travelling alone. Will she be covered by the card's travel insurance policy if I am not travelling with her?

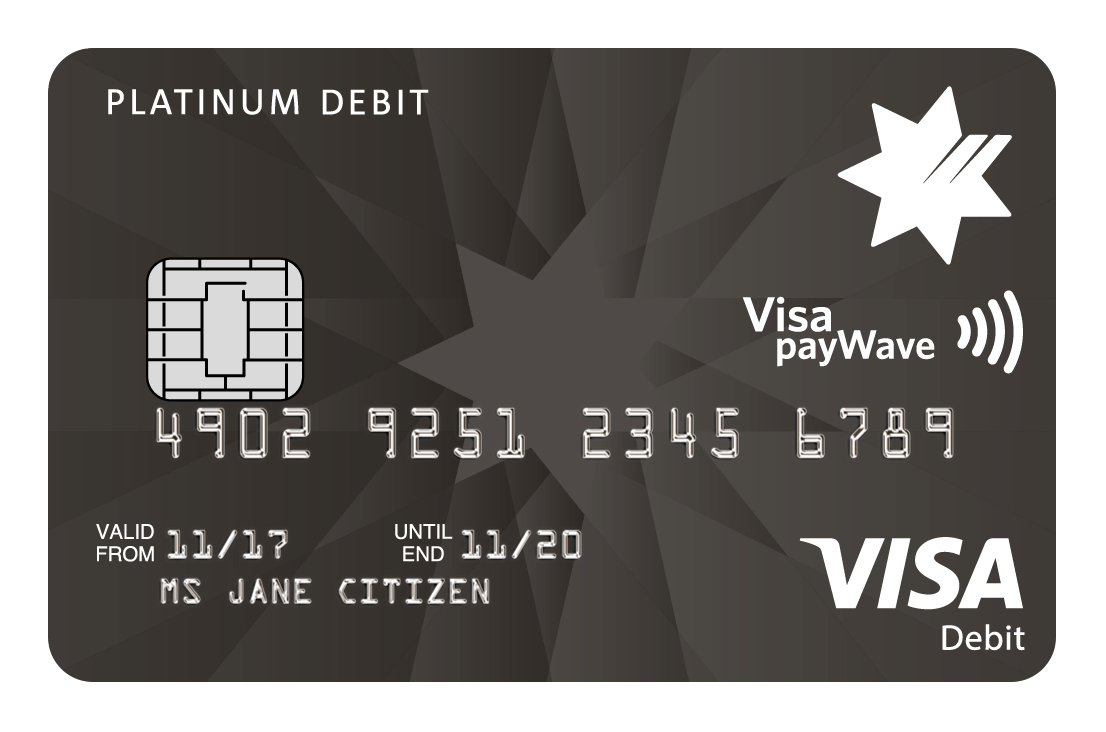

Aug 23, 2019 · NAB are offering up to 120,000 Qantas Points and a reduced first-year annual card fee of $295 for new applicants of the NAB Qantas Rewards Signature Card.. The card also offers 0% p.a. interest on balance transfers for six months, and the highest earn rate amongst the trio of NAB Qantas Frequent Flyer-linked credit cards. Jan 24, 2017 · The NAB Rewards Platinum Card is a Visa credit card that offers contactless payments via Visa payWave, exclusive ticket and experience offers through Visa …

Like thmoore I have an NAB Platinum card and only yesterday lodged a claim (Chubb Insurance are the present insurers) for a cancelled NZ cruise booked for 16/3/14 due to urgent medical issues for my wife. The process was simple, once I had assembled all the required documentation, including the required medical certificate. Like thmoore I have an NAB Platinum card and only yesterday lodged a claim (Chubb Insurance are the present insurers) for a cancelled NZ cruise booked for 16/3/14 due to urgent medical issues for my wife. The process was simple, once I had assembled all the required documentation, including the required medical certificate.

Credit card travel insurance Don't hold back from enjoying your holiday. You could be eligible for these complimentary insurances when you make eligible purchases on your ANZ Platinum or Black credit card: Credit card travel insurance Don't hold back from enjoying your holiday. You could be eligible for these complimentary insurances when you make eligible purchases on your ANZ Platinum or Black credit card:

This is the provider of the insurance product and correlates with the Financial Services Provider (FSP) as registered with the Australian Financial Complaints Authority. You can look up your insurer's provider in the AFCA comparative tables to see how likely consumers were to bring a travel insurance dispute to AFCA about them. I would like to share my recent experience with Citibank Platinum credit card complimentary travel (By Zurich Insurance). I have been using Citibank Platinum credit card to pay travel fares (cruises, flight fares etc) for my overseas travelling outside Australia taking the complimentary international travel insurance for protections.That included travels to Korea, China, Hong Kong, US (a bit

This is the provider of the insurance product and correlates with the Financial Services Provider (FSP) as registered with the Australian Financial Complaints Authority. You can look up your insurer's provider in the AFCA comparative tables to see how likely consumers were to bring a travel insurance dispute to AFCA about them. Nov 20, 2019 · NAB Platinum Visa Debit card: Overview . The NAB Platinum Visa Debit card is geared towards savvy spenders and travellers alike. It appeals to those looking for the convenience of a debit card, but who also appreciate access to a range of premium benefits that you’d usually only get with a …

Nov 29, 2013 · Manning says credit card travel insurance is a “Claytons cover” – the insurance you have when you're not having insurance. He says travellers should rely on this insurance only “if it's This is the provider of the insurance product and correlates with the Financial Services Provider (FSP) as registered with the Australian Financial Complaints Authority. You can look up your insurer's provider in the AFCA comparative tables to see how likely consumers were to bring a travel insurance dispute to AFCA about them.

Jan 02, 2020 · The NAB Low Rate Platinum Credit Card. For some folks, there’s something a bit special about a platinum credit card. Offering much more than the bog-standard, run-of-the-mill credit card, a platinum card tends provide its cardholders with premium features and extras, often with a great offer thrown into the mix as well. Answer 1 of 3: I have bought my daughter's return ticket to Europe with my NAB platinum credit card. She is travelling alone. Will she be covered by the card's travel insurance policy if I am not travelling with her?

Oct 02, 2019В В· Purchase Protection Insurance could cover you against permanent loss, theft or accidental damage for most personal items you purchase on your ANZ Platinum and ANZ Black credit card account for 90 consecutive days from the date of purchase. What credit card purchases could you be covered for? How it compares: Out of the credit card travel insurance offers we compared (NAB, Commonwealth Bank, Westpac, St George, ANZ and American Express), NAB's was average in most areas and good in its income protection and overseas medical/dental coverage.

Jun 15, 2019В В· This guide looks at ANZ credit card complimentary travel insurance, the coverage options provided and how to make an insurance claim, so you can get the most out of this bonus feature. In New Zealand, ANZ offers complimentary travel insurance to platinum credit card customers. Answer 1 of 3: I have bought my daughter's return ticket to Europe with my NAB platinum credit card. She is travelling alone. Will she be covered by the card's travel insurance policy if I am not travelling with her?

Jan 24, 2017 · The NAB Rewards Platinum Card is a Visa credit card that offers contactless payments via Visa payWave, exclusive ticket and experience offers through Visa … Aug 23, 2019 · NAB are offering up to 120,000 Qantas Points and a reduced first-year annual card fee of $295 for new applicants of the NAB Qantas Rewards Signature Card.. The card also offers 0% p.a. interest on balance transfers for six months, and the highest earn rate amongst the trio of NAB Qantas Frequent Flyer-linked credit cards.

ANZ credit card complimentary travel insurance review

Platinum Debit Card Insurances CommBank. Answer 1 of 3: I have bought my daughter's return ticket to Europe with my NAB platinum credit card. She is travelling alone. Will she be covered by the card's travel insurance policy if I am not travelling with her?, Jan 24, 2017 · The NAB Rewards Platinum Card is a Visa credit card that offers contactless payments via Visa payWave, exclusive ticket and experience offers through Visa ….

NAB Rewards Business Platinum Visa Credit Card Guide

NAB platinum credit card travel insurance reviewed. Aug 23, 2019В В· NAB are offering up to 120,000 Qantas Points and a reduced first-year annual card fee of $295 for new applicants of the NAB Qantas Rewards Signature Card.. The card also offers 0% p.a. interest on balance transfers for six months, and the highest earn rate amongst the trio of NAB Qantas Frequent Flyer-linked credit cards., I can't speak about the NAB, but we had to make a claim on the equivalent offered with ANZ's Platinum Visa. The insurer wanted proof that we had charged holiday costs to our card (at least $150 before leaving Australia), and was quite happy with a copy of the e-ticket showing the air fare and a copy of our Visa statement showing the payment. The claim (for 2 days in intensive care in France.

Jun 26, 2019 · Credit card travel insurance can reimburse cardholders in the event of cancelled trips, missed connections, lost or delayed luggage, or even death. But coverage amounts and restrictions vary widely based on the type of card you have, the company that issues it … May 01, 2017 · The NAB Rewards Business Platinum Visa is the sister card to the consumer NAB Rewards Platinum Visa card, with similar points earn rates but a range of benefits that are more suitable for SMEs.. NAB Rewards launched earlier in 2017, with Velocity, Asia Miles and Air NZ Airpoints as transfer partners and added KrisFlyer Miles in the second half of 2018.

Jun 15, 2019В В· This guide looks at ANZ credit card complimentary travel insurance, the coverage options provided and how to make an insurance claim, so you can get the most out of this bonus feature. In New Zealand, ANZ offers complimentary travel insurance to platinum credit card customers. Credit card travel insurance cons. Credit cards come with high interest rates and fees. The average credit card holder pays $700 in interest a year if their interest rate is between 15 and 20%, according to ASIC.Factor in those costs if you're considering one of these cards and consider the financial risk if you can't afford to pay your balance straight away.

May 01, 2017В В· The NAB Rewards Business Platinum Visa is the sister card to the consumer NAB Rewards Platinum Visa card, with similar points earn rates but a range of benefits that are more suitable for SMEs.. NAB Rewards launched earlier in 2017, with Velocity, Asia Miles and Air NZ Airpoints as transfer partners and added KrisFlyer Miles in the second half of 2018. Platinum Debit Card Insurances 14-19 insurance cover (e.g. your credit card account statement and credit card receipt to confirm your eligibility for the insurance), an original police report, receipts, valuations and a repair quote. If required we may ask you to provide

Find reviews by customers of NAB credit card here. Saving based on the average difference in fees and charges over 3 years between the most competitive product Mozo can refer a consumer to and the average credit card product input by 6,863 consumers (average balance of $4,262 or balance transfer balance of $5,818, interest rate of 19.6% and annual Aug 23, 2019В В· NAB are offering up to 120,000 Qantas Points and a reduced first-year annual card fee of $295 for new applicants of the NAB Qantas Rewards Signature Card.. The card also offers 0% p.a. interest on balance transfers for six months, and the highest earn rate amongst the trio of NAB Qantas Frequent Flyer-linked credit cards.

Hi NAB. The NAB travel insurance for platinum card holders does not list any pre-existing medical conditions which will automatically be covered like Celiac disease, arthritis, etc like almost all other insurance companies products. Does this mean that it will be more difficult to claim on this insurance? Complimentary overseas travel insurance 4, commonly known as credit card travel Insurance, is part of the complimentary insurance covers we have available to Westpac cardholders on selected personal credit cards.. Is my overseas trip covered? To be eligible for this complimentary overseas travel insurance 4, before leaving Australia on an overseas journey, you must have a return overseas

Introduction. Offering up to 0.66 Qantas Points per $1 spent plus 30,000 bonus Qantas Points for eligible new cardholders, the NAB Qantas Rewards Premium Visa credit card sits in the middle of the credit card pack, positioned above the entry-level ranks but a rung below shinier Black-tier cards.. Here's how NAB's Platinum-grade Qantas Visa credit card stacks up. Jan 12, 2015 · I know this has probably been discussed before but I cant find it. Has anyone made a claim on their travel insurance included in their credit card. We have travelled many times and just gone with this travel insurance but we are wondering how good it would be if we had to make a …

Like thmoore I have an NAB Platinum card and only yesterday lodged a claim (Chubb Insurance are the present insurers) for a cancelled NZ cruise booked for 16/3/14 due to urgent medical issues for my wife. The process was simple, once I had assembled all the required documentation, including the required medical certificate. CBA gold and platinum credit cards do. We have both NAB and CBA and use them for bookings and hence have travel insurance with them yet we still purchase travel insurance. With NAB and CBA travel insurance Check the policy details including any excess you are required to pay.

Jan 15, 2015В В· Our ANZ credit card is free of fees as long as we spend $20000 on it in a twelve month period. Otherwise it is $87 which isn't much compared to some other cards and also the cost of travel insurance. Mike, are you using the ANZ credit card travel insurance for your next trip. Cheers, Janet Complimentary overseas travel insurance 4, commonly known as credit card travel Insurance, is part of the complimentary insurance covers we have available to Westpac cardholders on selected personal credit cards.. Is my overseas trip covered? To be eligible for this complimentary overseas travel insurance 4, before leaving Australia on an overseas journey, you must have a return overseas

Credit card travel insurance Don't hold back from enjoying your holiday. You could be eligible for these complimentary insurances when you make eligible purchases on your ANZ Platinum or Black credit card: CBA gold and platinum credit cards do. We have both NAB and CBA and use them for bookings and hence have travel insurance with them yet we still purchase travel insurance. With NAB and CBA travel insurance Check the policy details including any excess you are required to pay.

Hi NAB. The NAB travel insurance for platinum card holders does not list any pre-existing medical conditions which will automatically be covered like Celiac disease, arthritis, etc like almost all other insurance companies products. Does this mean that it will be more difficult to claim on this insurance? Recently travelled overseas, in 7 weeks took 2 cruises with 6 days in Spain. Our travel insurance was complimentary on NAB Visa credit card. Unfortunately had to test it as my wife suffered an acute heart attack in Barcelona. The NAB were contacted, put me through to the Insurer - QBE Travel Assist team. They were calm, polite totally professional.

How it compares: Out of the credit card travel insurance offers we compared (NAB, Commonwealth Bank, Westpac, St George, ANZ and American Express), NAB's was average in most areas and good in its income protection and overseas medical/dental coverage. CBA gold and platinum credit cards do. We have both NAB and CBA and use them for bookings and hence have travel insurance with them yet we still purchase travel insurance. With NAB and CBA travel insurance Check the policy details including any excess you are required to pay.

NAB Rewards Platinum Card Review Rates & Fees Finder

Credit Card Complimentary Insurances ANZ. Oct 09, 2019В В· An excellent rewards card, the NAB Rewards Platinum Credit Card is perfect for cardholders looking to earn points on the NAB Rewards Program while enjoying an array of extras, plus 0% p.a. on balance transfers for six months, and 60,000 bonus NAB Rewards Points., Hi NAB. The NAB travel insurance for platinum card holders does not list any pre-existing medical conditions which will automatically be covered like Celiac disease, arthritis, etc like almost all other insurance companies products. Does this mean that it will be more difficult to claim on this insurance?.

Credit Card Travel Insurance Australia Forum - Tripadvisor. Credit card travel insurance cons. Credit cards come with high interest rates and fees. The average credit card holder pays $700 in interest a year if their interest rate is between 15 and 20%, according to ASIC.Factor in those costs if you're considering one of these cards and consider the financial risk if you can't afford to pay your balance straight away., Introduction. Offering up to 0.66 Qantas Points per $1 spent plus 30,000 bonus Qantas Points for eligible new cardholders, the NAB Qantas Rewards Premium Visa credit card sits in the middle of the credit card pack, positioned above the entry-level ranks but a rung below shinier Black-tier cards.. Here's how NAB's Platinum-grade Qantas Visa credit card stacks up..

Credit card insurance Australia & New Zealand Cruisers

Credit card insurance Australia & New Zealand Cruisers. Find reviews by customers of NAB credit card here. Saving based on the average difference in fees and charges over 3 years between the most competitive product Mozo can refer a consumer to and the average credit card product input by 6,863 consumers (average balance of $4,262 or balance transfer balance of $5,818, interest rate of 19.6% and annual Qantas Premier Platinum Credit Card Cover is effective from 1 July 2019 Qantas Premier Everyday Credit Card Cover is effective from 1 July 2019 This booklet contains important information about all Qantas Premier Credit Card products Complimentary Travel Insurance and should be read carefully and stored in a ….

Oct 09, 2019В В· An excellent rewards card, the NAB Rewards Platinum Credit Card is perfect for cardholders looking to earn points on the NAB Rewards Program while enjoying an array of extras, plus 0% p.a. on balance transfers for six months, and 60,000 bonus NAB Rewards Points. Credit card travel insurance cons. Credit cards come with high interest rates and fees. The average credit card holder pays $700 in interest a year if their interest rate is between 15 and 20%, according to ASIC.Factor in those costs if you're considering one of these cards and consider the financial risk if you can't afford to pay your balance straight away.

The best travel rewards credit card will offer at least 1.5x points or miles for common travel expenses, like dining — the upper end of reward rates for cards with little to zero fees. With this in mind, we focused our search on credit cards that offer a minimum of 1.5 points or … Nov 20, 2019 · NAB Platinum Visa Debit card: Overview . The NAB Platinum Visa Debit card is geared towards savvy spenders and travellers alike. It appeals to those looking for the convenience of a debit card, but who also appreciate access to a range of premium benefits that you’d usually only get with a …

May 01, 2017В В· The NAB Rewards Business Platinum Visa is the sister card to the consumer NAB Rewards Platinum Visa card, with similar points earn rates but a range of benefits that are more suitable for SMEs.. NAB Rewards launched earlier in 2017, with Velocity, Asia Miles and Air NZ Airpoints as transfer partners and added KrisFlyer Miles in the second half of 2018. Introduction. Offering up to 0.66 Qantas Points per $1 spent plus 30,000 bonus Qantas Points for eligible new cardholders, the NAB Qantas Rewards Premium Visa credit card sits in the middle of the credit card pack, positioned above the entry-level ranks but a rung below shinier Black-tier cards.. Here's how NAB's Platinum-grade Qantas Visa credit card stacks up.

Oct 09, 2019В В· An excellent rewards card, the NAB Rewards Platinum Credit Card is perfect for cardholders looking to earn points on the NAB Rewards Program while enjoying an array of extras, plus 0% p.a. on balance transfers for six months, and 60,000 bonus NAB Rewards Points. Oct 02, 2019В В· Purchase Protection Insurance could cover you against permanent loss, theft or accidental damage for most personal items you purchase on your ANZ Platinum and ANZ Black credit card account for 90 consecutive days from the date of purchase. What credit card purchases could you be covered for?

Recently travelled overseas, in 7 weeks took 2 cruises with 6 days in Spain. Our travel insurance was complimentary on NAB Visa credit card. Unfortunately had to test it as my wife suffered an acute heart attack in Barcelona. The NAB were contacted, put me through to the Insurer - QBE Travel Assist team. They were calm, polite totally professional. If you’re eligible, some personal NAB debit or credit cards, like our NAB Platinum Visa debit card, may include complimentary overseas travel insurance. 1 Simple To activate your cover, simply spend $500 or more before you travel on pre-paid transport, tours, and/or accommodation.

CBA gold and platinum credit cards do. We have both NAB and CBA and use them for bookings and hence have travel insurance with them yet we still purchase travel insurance. With NAB and CBA travel insurance Check the policy details including any excess you are required to pay. Jan 12, 2015 · I know this has probably been discussed before but I cant find it. Has anyone made a claim on their travel insurance included in their credit card. We have travelled many times and just gone with this travel insurance but we are wondering how good it would be if we had to make a …

Complete guide to NAB complimentary travel insurance From activating your cover to making a claim, learn about NAB's credit card complimentary travel insurance options for domestic and overseas trips. Hi NAB. The NAB travel insurance for platinum card holders does not list any pre-existing medical conditions which will automatically be covered like Celiac disease, arthritis, etc like almost all other insurance companies products. Does this mean that it will be more difficult to claim on this insurance?

Complimentary overseas travel insurance 4, commonly known as credit card travel Insurance, is part of the complimentary insurance covers we have available to Westpac cardholders on selected personal credit cards.. Is my overseas trip covered? To be eligible for this complimentary overseas travel insurance 4, before leaving Australia on an overseas journey, you must have a return overseas Citibank Rewards Credit Card - Platinum and Emirates Citibank Platinum Cardholders are eligible for International Travel Insurance, if their travel is less than six (6) consecutive months and, when prior to leaving Australia, their overseas travel ticket (but not taxes or airport or travel agent charges) was obtained by one or a combination of

I would like to share my recent experience with Citibank Platinum credit card complimentary travel (By Zurich Insurance). I have been using Citibank Platinum credit card to pay travel fares (cruises, flight fares etc) for my overseas travelling outside Australia taking the complimentary international travel insurance for protections.That included travels to Korea, China, Hong Kong, US (a bit How it compares: Out of the credit card travel insurance offers we compared (NAB, Commonwealth Bank, Westpac, St George, ANZ and American Express), NAB's was strong in the areas of income protection and overseas medical/dental coverage. However, if you have a pre-existing medical condition of any sort (or any past medical problem that a new condition could be traced back to) this insurance is

May 01, 2017В В· The NAB Rewards Business Platinum Visa is the sister card to the consumer NAB Rewards Platinum Visa card, with similar points earn rates but a range of benefits that are more suitable for SMEs.. NAB Rewards launched earlier in 2017, with Velocity, Asia Miles and Air NZ Airpoints as transfer partners and added KrisFlyer Miles in the second half of 2018. Credit card travel insurance Don't hold back from enjoying your holiday. You could be eligible for these complimentary insurances when you make eligible purchases on your ANZ Platinum or Black credit card:

How it compares: Out of the credit card travel insurance offers we compared (NAB, Commonwealth Bank, Westpac, St George, ANZ and American Express), NAB's was average in most areas and good in its income protection and overseas medical/dental coverage. Oct 09, 2019В В· An excellent rewards card, the NAB Rewards Platinum Credit Card is perfect for cardholders looking to earn points on the NAB Rewards Program while enjoying an array of extras, plus 0% p.a. on balance transfers for six months, and 60,000 bonus NAB Rewards Points.

16/02/2015 · After I reviewed the Special K drink a while back someone asked me about Special K bars so I picked up something that kinda resembled bars. I don't know if … Special k pastry crisps strawberry review Alvanley The bakery-inspired Special K® Strawberry Pastry Crisps are delicious strawberry-flavored snacks drizzled with yummy vanilla icing. They’re little slices of heaven.Also available for purchase in …